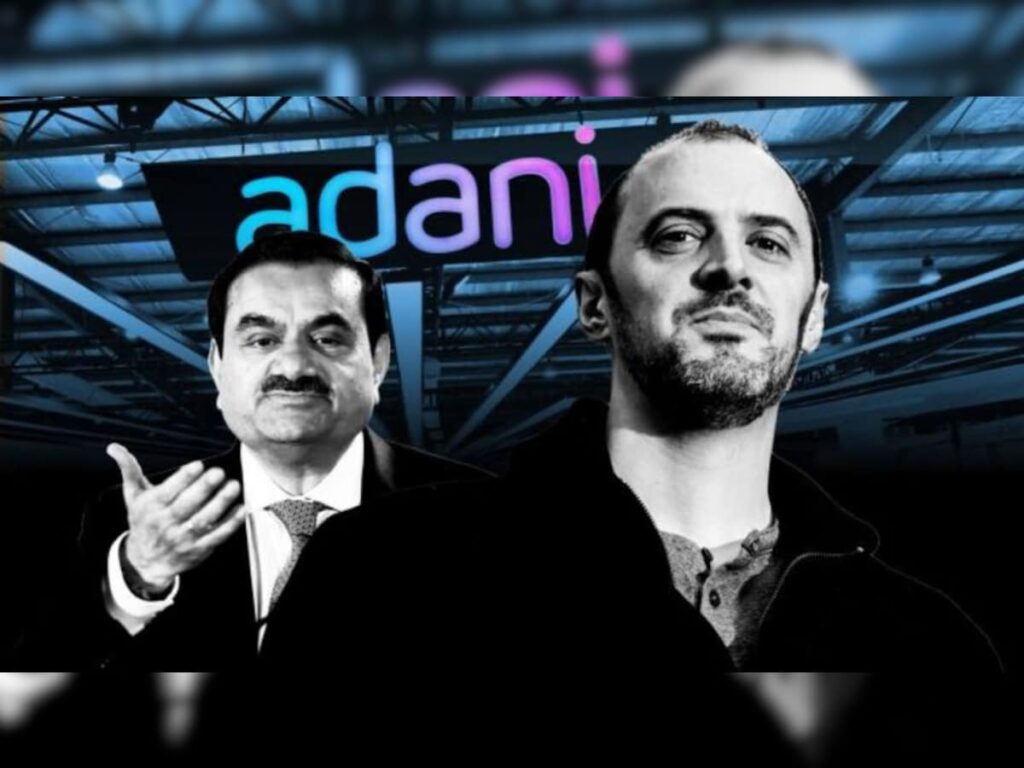

In the matter, knowledgeable sources have indicated that the regulatory authority for India’s markets has initiated an investigation into a non-profit media organization named fund, which allegedly invested millions of dollars in publicly traded shares of Adani Group’s businesses.

As per the Organized Crime and Corruption Reporting Project (OCCRP), offshore entities based in Mauritius acquired shares ranging from 8% to 14% in four units of the Adani Group – Adani Power, Adani Enterprises, Adani Ports, and Adani Transmission. The Adani Group has dismissed this report. Sources state that the nominated fund is already part of the regulatory investigation into Adani Group’s alleged violation of public float norms and will be considered in light of any new information.

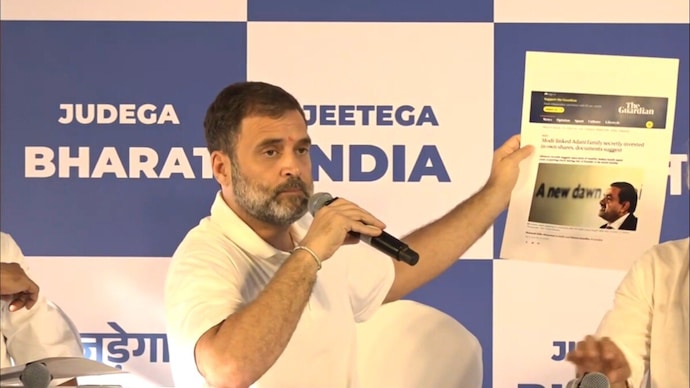

Rahul Gandhi Questions PM Modi’s Silence Over Adani: Calls for Inquiry into Adani Allegations

Congress leader Rahul Gandhi accused Prime Minister Narendra Modi of “shielding” someone and questioned why he isn’t initiating an investigation into the fresh allegations of internal business practices against the Adani Group. Speaking at a press conference in Mumbai ahead of the G20 Summit, Rahul Gandhi raised questions about PM Modi’s silence on the Adani issue and demanded an inquiry by the Joint Parliamentary Committee (JPC).

Gandhi remarked that the Prime Minister’s silence was significant, especially before the G20 Summit, where leaders from around the world are expected to gather in India next month.

At the very least, JPC’s permission should be sought, and a thorough investigation should take place. I don’t understand why the Prime Minister isn’t initiating an investigation? Why is he silent, and why have those responsible been hidden behind bars? Just before the arrival of G20 leaders, this is raising very serious questions for the Prime Minister… It’s important that this issue is clarified before their (G20 leaders) arrival,” Gandhi said.

For countries like India, it is of paramount importance that our economic environment and the businesses operated here provide equal opportunities and transparency. Today, two global financial newspapers have raised a very crucial question. This is not some random news article. These news pieces influence investments in India and shape the perception of India around the world…” he said.

The Adani Group has denied the allegations made by OCCRP, labeling them as “rehashed,” and backed by “Soros-funded interests.”

Adani Group has dismissed the allegations brought forward by the Organized Crime and Corruption Reporting Project (OCCRP), stating that the reports “rehash” baseless allegations and are supported by a section of foreign media funded by “Soros-funded interests,” aiming to revive the discredited Hidenburg Report.

The matter attained finality in March 2023, when the Supreme Court of India delivered a verdict in our favor. Clearly, since no overvaluation occurred, these allegations hold no relevance or basis for the money transfers,” Adani Group emphasized.

“It’s noteworthy that this FPI (Foreign Portfolio Investor) was already part of SEBI’s investigation. As per the expert committee appointed by the Supreme Court, there’s no evidence of violations of minimum public shareholding (MPS) requirements or manipulation of stock prices,” the Group stated firmly.

According to its website, OCCRP describes itself as a “consortium of 24 non-profit investigative centers” formed into a joint reporting platform, which spans across Europe, Africa, Asia, and Latin America.

Nice blog 😊

Thanks

👍

Thanks

[…] Read me: Unveiling the Adani Controversy: Market Investigation, Political Ripples, and Global Impact […]